Severely impacted by the Covid-19 pandemic, China is still on the road to economic recovery, which will take some time. With the evolving purchasing power and consumption habits of the population, the wine market is attracting increasing attention from the Chinese, who still only consume about 1.2 liters of wine per person per year. Foreign wines are still seen as a symbol of quality and craftsmanship. So, how can you break into the Chinese market and seize new business opportunities?

The Chinese wine market evolves every year and faces numerous challenges. Let's take a look at trends and prospects for exporting wine and spirits to the Middle Kingdom. In 2020, 53.2% of the wine consumed was locally produced, which does not prevent China from appreciating foreign wines in large quantities.

Between 2018 and 2020, the production and sales of Chinese wines decreased from 11.6 million hectoliters (mhl) to 4.13 mhl. This drop benefited imported wines, particularly from Europe. French wines, symbols of quality and craftsmanship, enjoy strong recognition in China. Consumers are now better informed: they are interested not only in the taste but also in the wine culture. China is also a major client of Chile and Australia, with agreements facilitating wine imports from both countries.

Wine consumption is becoming more accessible among the middle class (which represents nearly 400 million people). Due to their extravagant and luxurious image, foreign wines and spirits remain popular. Associated with social status, they are often given as gifts or served at official events. With its significant potential, China remains very attractive for wine exporters, although it has slowed down since the Covid crisis, which has profoundly changed wine and spirit purchasing patterns, with many sales now happening through social media networks.

In China, two decrees impose reporting requirements for food products in terms of traceability and labeling. For sanitary reasons, all production sites must be identified. Wine labels must also be translated according to Chinese standards and approved by the CIQ (Inspection and Quarantine Service).

Regulations, however, can change and sometimes be incomplete, with information potentially being updated by Chinese customs. If you wish to export your products, it is essential to be accompanied and advised by local contacts (importers, customs agencies, representation offices, etc.).

China is the third-largest market for red wine consumption in the world. According to Global Data, , the wine market was valued at 42 billion dollars in 2021. It is expected to grow by over 11% by 2026.

While traditional local alcoholic beverages (such as the famous baijiu) remain the most popular, wealthier consumers are increasingly turning to imported spirits such as:

Imported wine represents about 40% of total wine sales in China. A symbol of taste and social status, it is usually sold at a higher price than domestic wines. The share of imports is the highest in the large urban centers of the country, where the wealthiest consumers and import businesses are concentrated.

One last figure to remember: French wine, for example, represents 30% of the wine imported into China. In 2021, the import volume of French wines amounted to 1.058 billion dollars. Thus, the Chinese market is still largely dominated by France, followed by Australia, Chile, Italy, and Spain.

Suzanne van Dyk - Marketing Director - Tokara, South Africa

"At Tokara, we leverage Gilbert & Gaillard International Challenge results in our various markets, including Canada, the Netherlands, and China. The Canadian and Chinese markets are new for us, and the medals have been instrumental in ensuring our wines’ quality. We also display the medals in our tasting room due to the high number of tourists we receive. "

Although currently in decline, the Chinese market continues to attract foreign producers. Social media, online sales, and events like wine fairs are areas where importers and distributors are betting on developing new growth channels (such as Chinese social networks like WeChat).

In China, packaging and awards displayed on products are particularly important. The Gilbert & Gaillard medal is highly appreciated due to its size and its shiny gold metal. Crafting your brand image is crucial for entering the Chinese market and appealing to consumers.

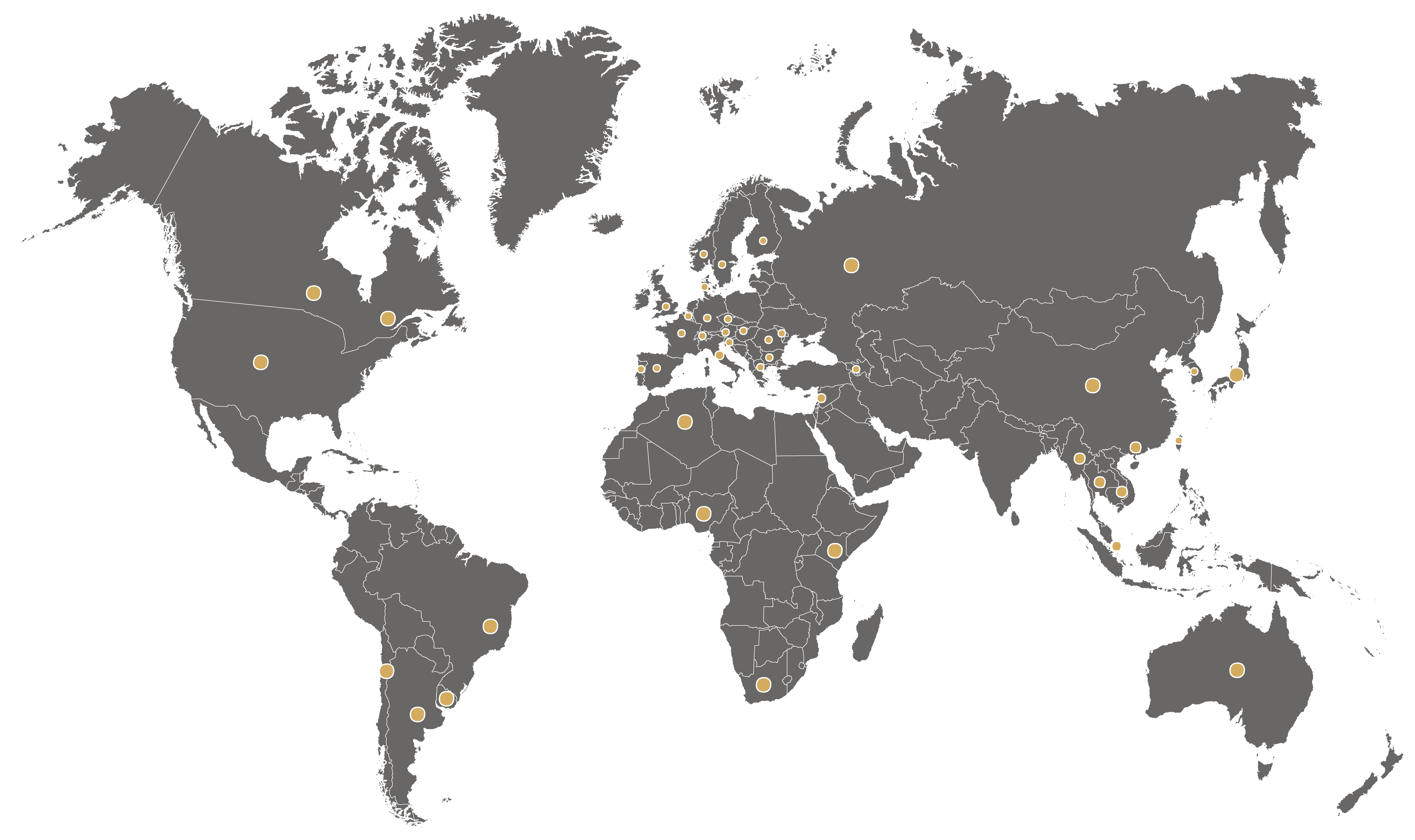

Using Gilbert & Gaillard medals for wine exportation means leveraging an internationally recognized wine competition with a 35-year history. Want to register your wines? Log in to your winemaker space, where you can access our database of over 10,000 importers and distributors, including our list of Chinese importers.